The Evolution of Business-Finance Integration

January 16 2024Today, financial management extends beyond traditional accounting and finance functions; it requires a simultaneous focus on both formulating and executing business strategies. To understand the meanings of financial businessification and business financialization, we must first delve into the three key levels of business-finance integration: financial-business integration, financial businessification, and business financialization. These three levels represent the increasingly close relationship between finance and business, highlighting their intertwined and interdependent nature in modern enterprises.

Financial-business integration signifies the seamless integration of financial management with business operations, emphasizing the pivotal role of finance in business decision-making. Financial businessification takes it a step further, underscoring the strategic nature of financial functions and the integration of financial expertise throughout the entire business decision-making process. Business financialization, on the other hand, emphasizes active participation by business teams in financial data, achieving a mutual understanding and collaboration between business and finance.

Behind this transformation, financial managers face unprecedented challenges and dilemmas. The uncertainties of global markets, rapid technological advancements, and frequent regulatory changes exert increasing pressure on financial managers as they strive to balance business growth and risk management. In this context, it becomes imperative to explore the different levels of business-finance integration to better comprehend and address the complexities of contemporary financial management.

Business-Finance Integration: Enhancing Operational Synergy Business-finance integration refers to the organic alignment of business and finance aspects in enterprise management, ensuring efficient connectivity among information flow, business processes, and capital flow. This integration goes beyond mere data fusion; it is manifested in collaborative development of mindset, management philosophy, and system architecture.

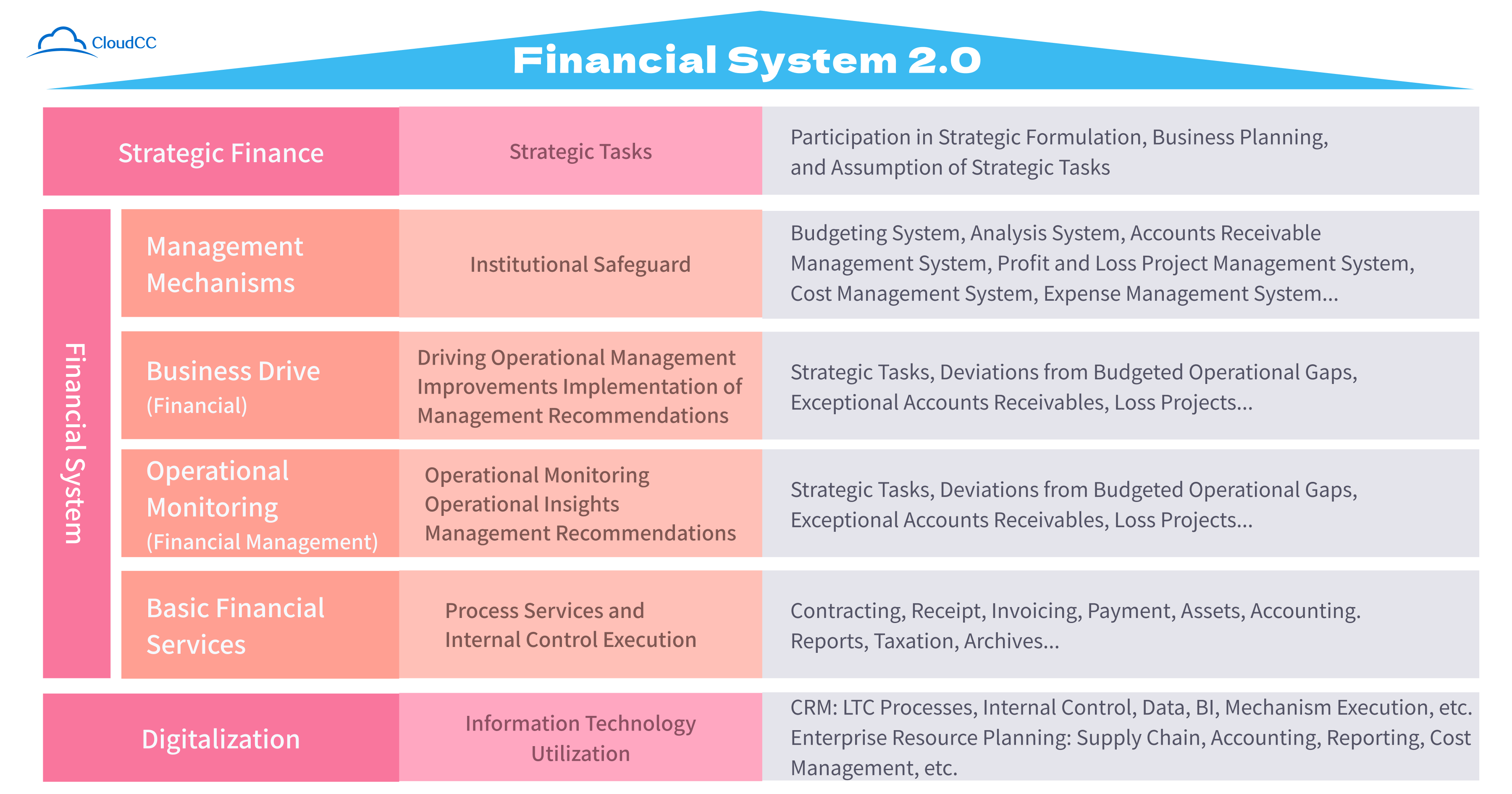

Business-finance integration can be categorized into three developmental stages: basic, intermediate, and advanced, corresponding to financial-business integration, financial businessification, and business financialization, respectively.

Financial Businessification: Bridging the Gap The key to financial businessification lies in bridging the gap between "financial proposition" and effectively driving solutions to operational issues, facilitating consensus-building, action planning, and continuous improvement on the business side. This encompasses five crucial levels: the process level, monitoring level, insight level, driving level, and goal level, with the driving level being the pivotal stage for transitioning from theoretical proposals to tangible victories.

In practical terms, financial driving force demands that finance professionals possess a solid foundation of expertise, effective communication and coordination skills, and the ability to drive action, thus fostering consensus and collaboration with business units. These elements constitute the critical components through which business finance truly adds value. Comprehensive budgeting, cost management, project management, accounts receivable management, and other domains all adhere to this financial management framework, emphasizing the activation of financial driving forces, and ensuring that financial management recommendations and initiatives are genuinely implemented, leading to tangible value contributions.