How to Manage Your Company Receivable

With continuous inflation, cash flow matters the most for a company and receivable is the most direct way of gaining cash flow.

Typically, a receivable process of a company starts with a contract signing with the client, and by fulfilling the order, the company outputs products or services before the buyer pays the company.

Here is how to manage the receivables of your company with CloudCC.

Step One: Formulate a receivable plan.

Use CloudCC’s Marketing Cloud to acquire customers and Sales Cloud to advance opportunities.

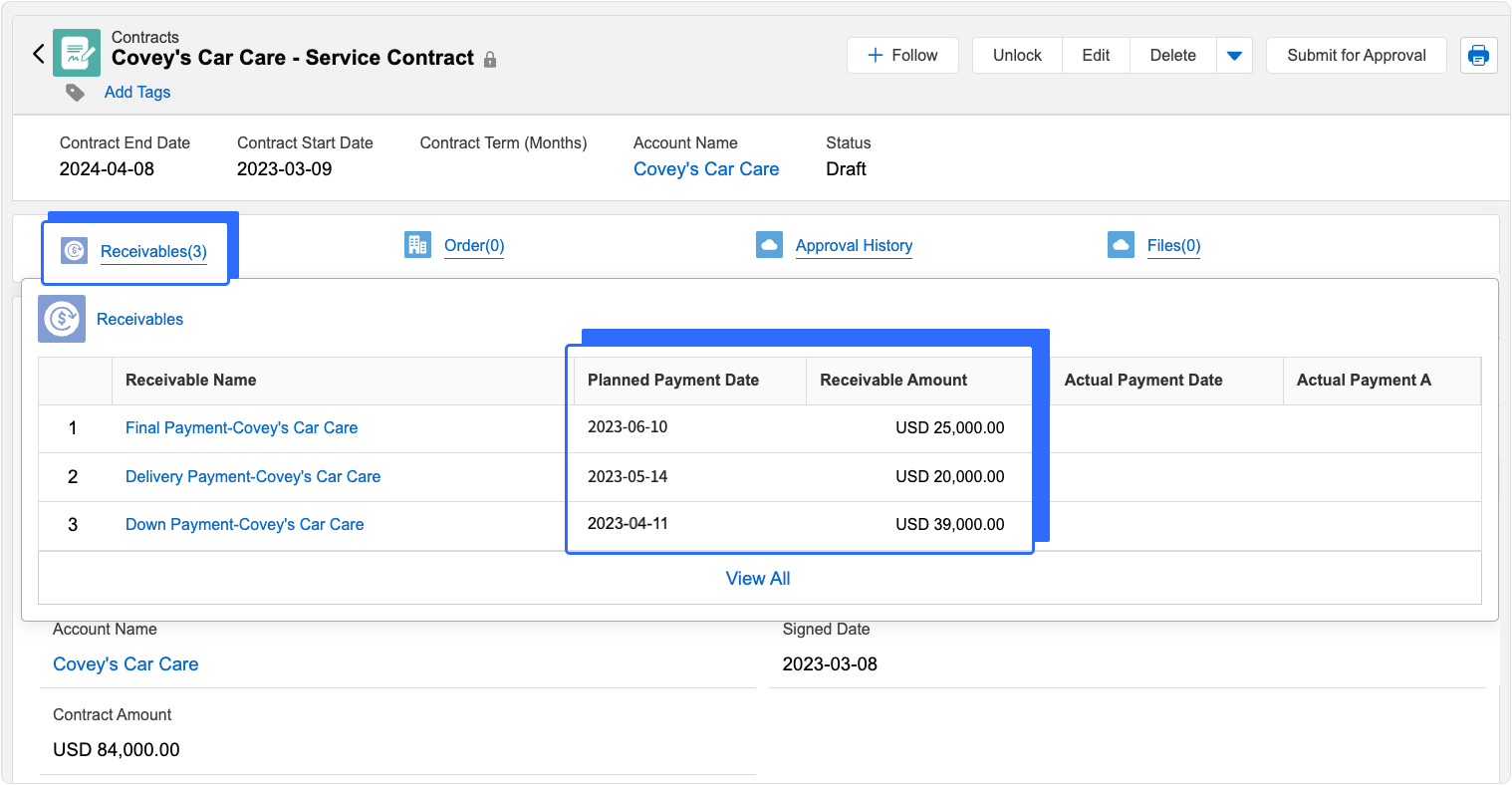

After an opportunity is won, the salesperson initiates contract signing. Typically, there are several receivables under one contract, such as a down payment, a delivery payment, and a final payment. The salesperson creates the three receivables according to the contract, the most important of which is the amount and the due date.

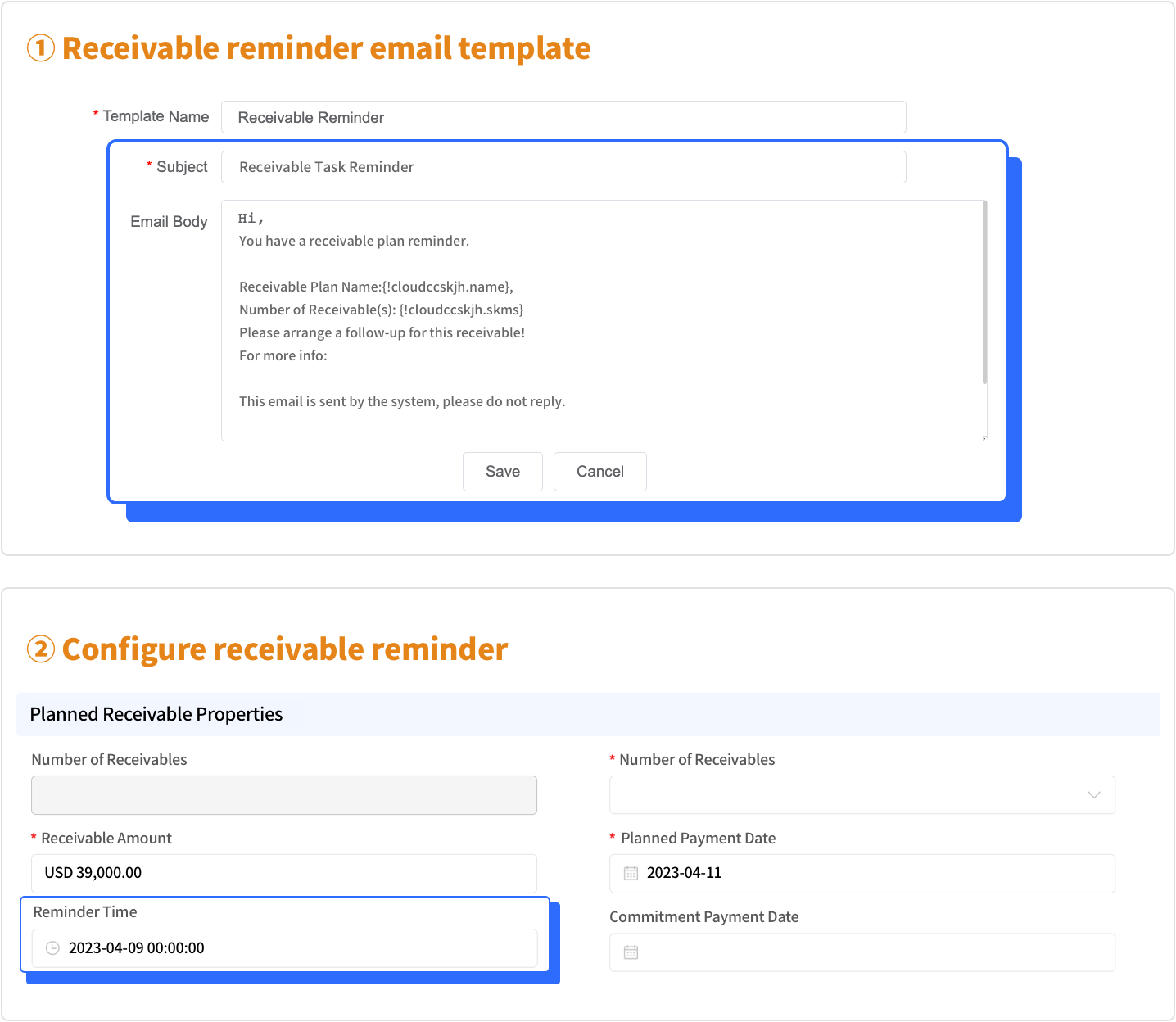

Further, the salesperson creates reminders of receivables for relevant personnel to receive email notifications.

Once the receivable plan is made, the salesperson may submit the contract itself and the receivable plan thereof into the Approval workflow where applications are approved by corresponding approvers. After approval is completed, the CloudCC system locks and archives the record so that nobody can change it.

Step Two: Reminders and Tasks.

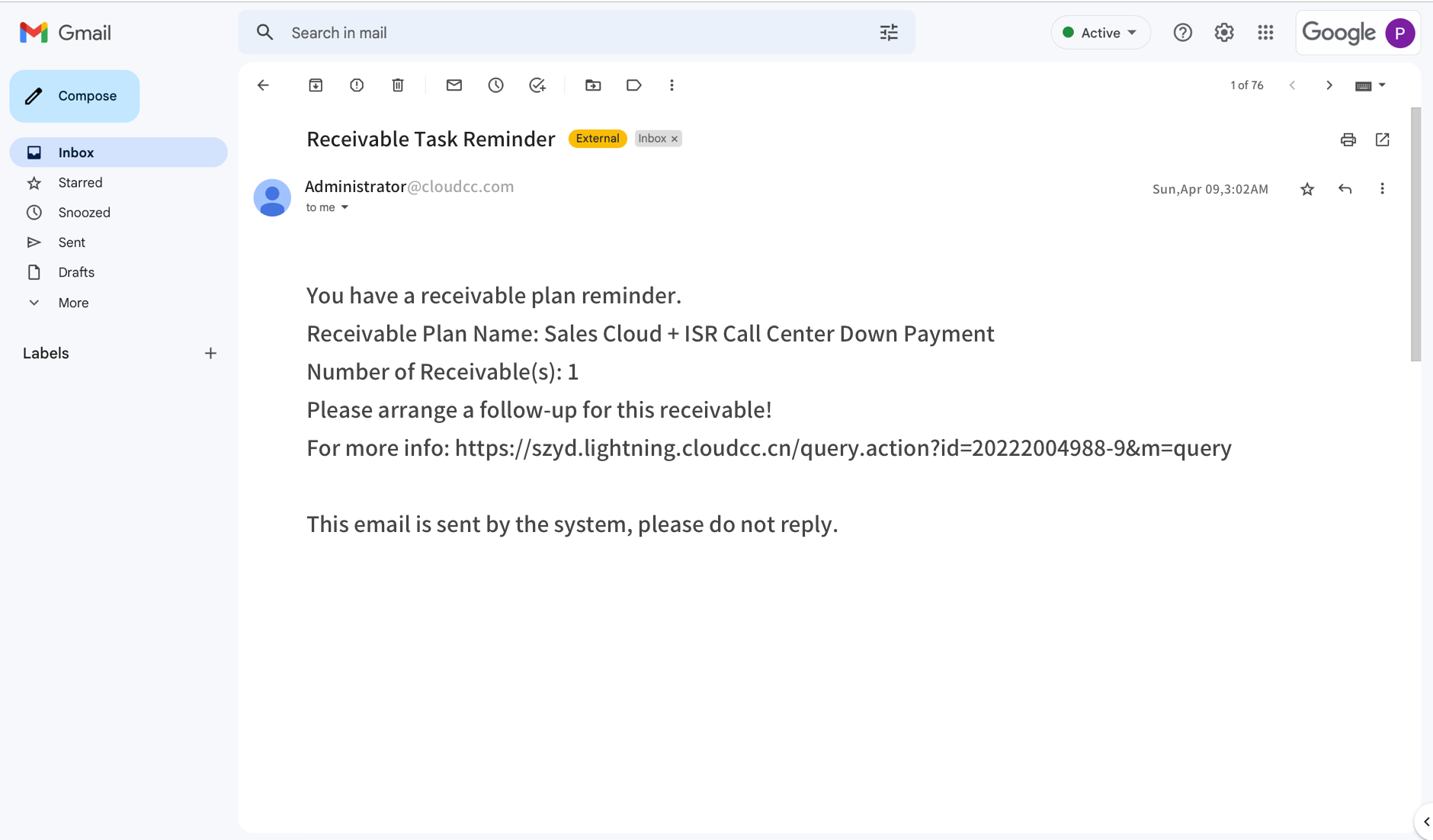

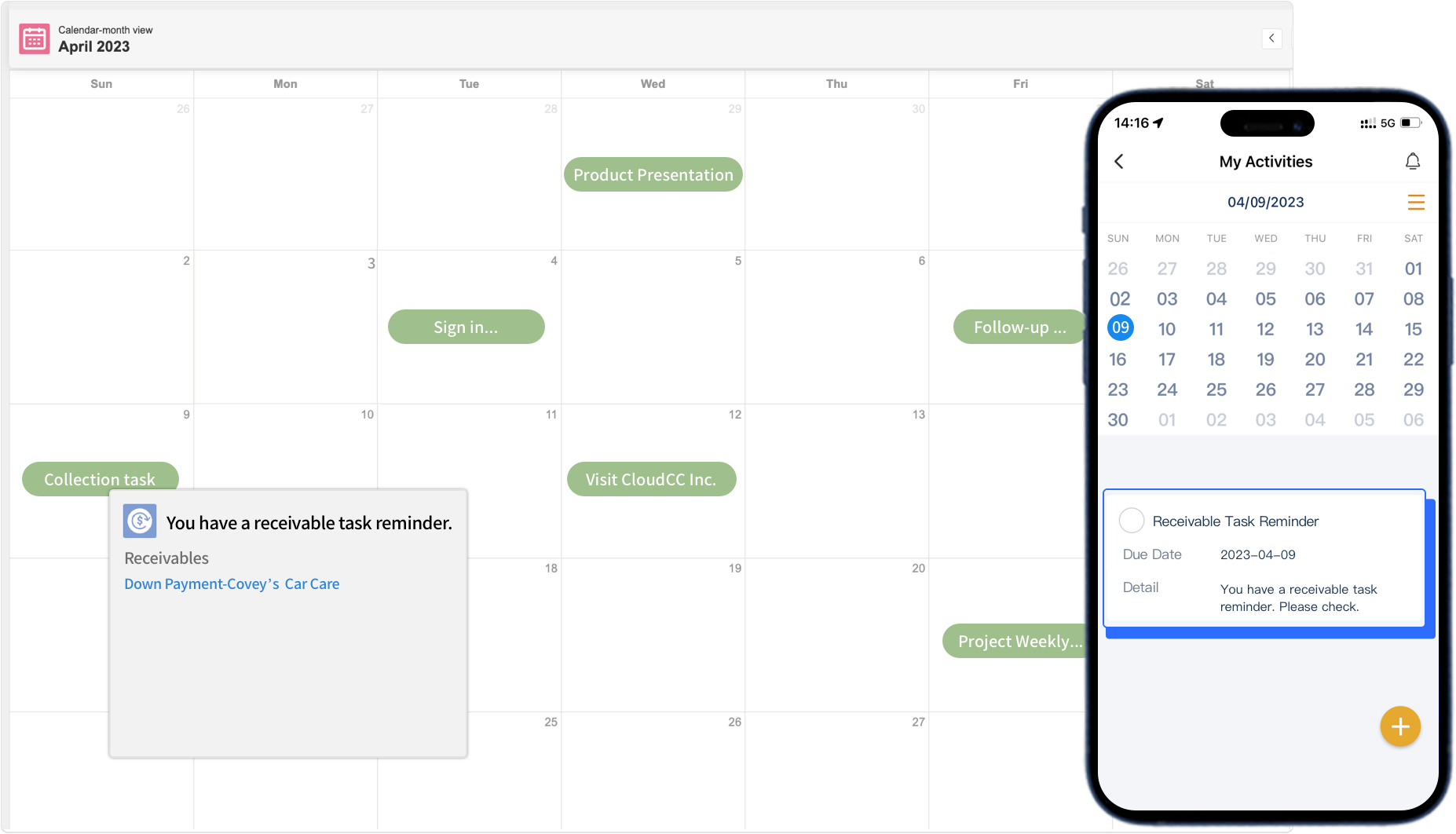

CloudCC will push emails and in-system notifications to corresponding personnel as pre-set reminders. The salesperson will know the payment needs to be reminded to the client.

Besides email reminders, we can also set up receivable tasks. With the Trigger function in CloudCC, the system assigns a receivable task to the responsible salesperson days before the receivable is due. The salesperson will receive a notification in the system and an email as task reminders.

With such double reminders, each payment is completed on schedule.

Step Three: Receivables

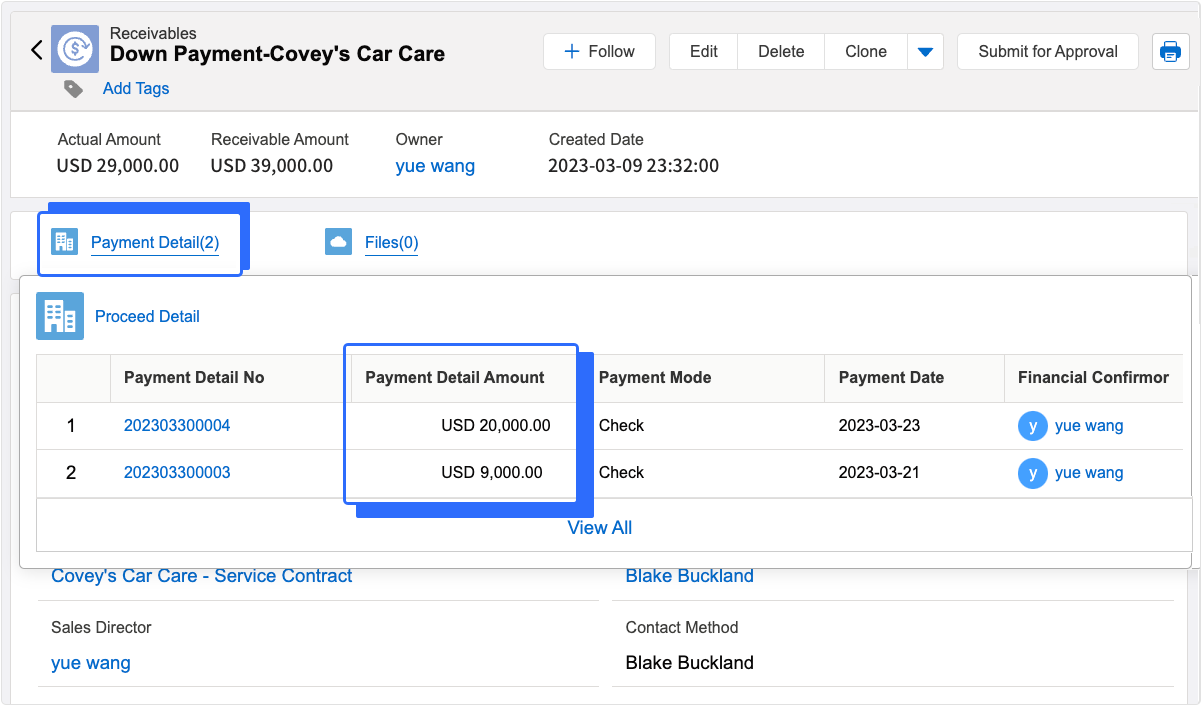

When the payment is received by the company, the receivable person creates this receivable under the Receivable Detail of the receivable plan.

After saving, this receivable is automatically summarized into the receivable plan and the amount due is updated. On condition that the amount due becomes 0, the completion rate reaches 100% and Receivable Completed is checked, and there will be no further tasks to execute for this receivable plan.

Step Four: Overdue Receivables

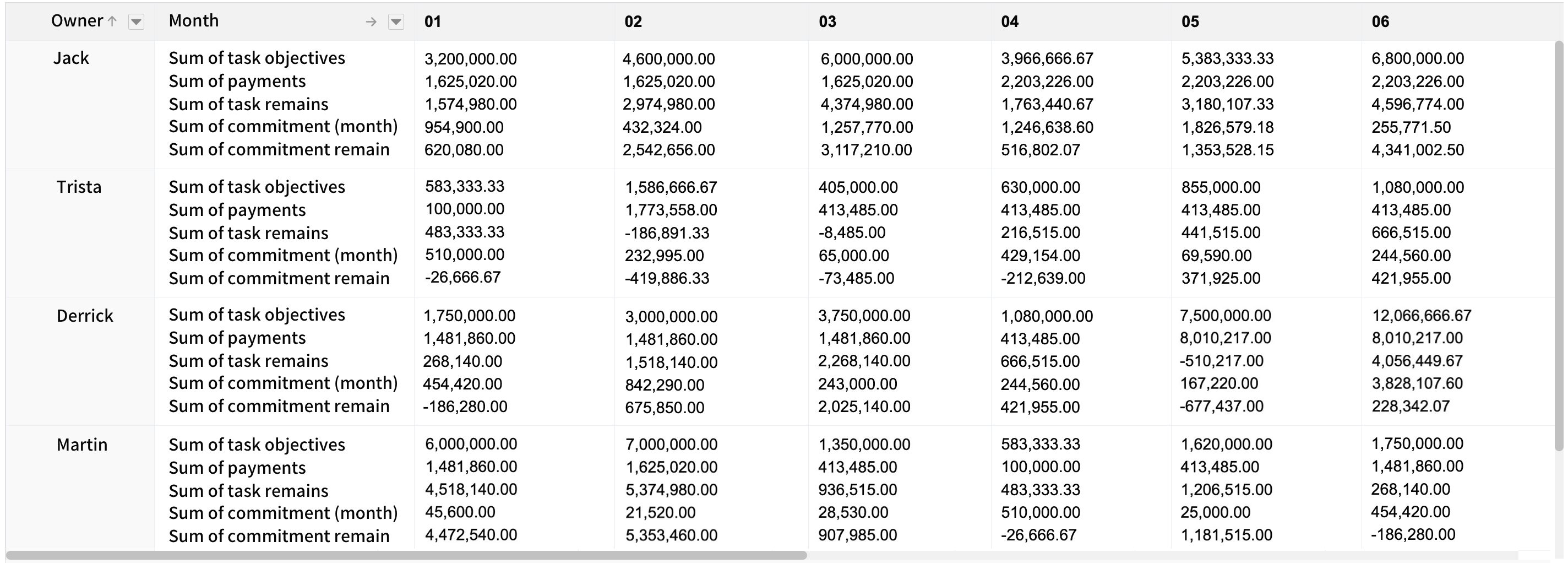

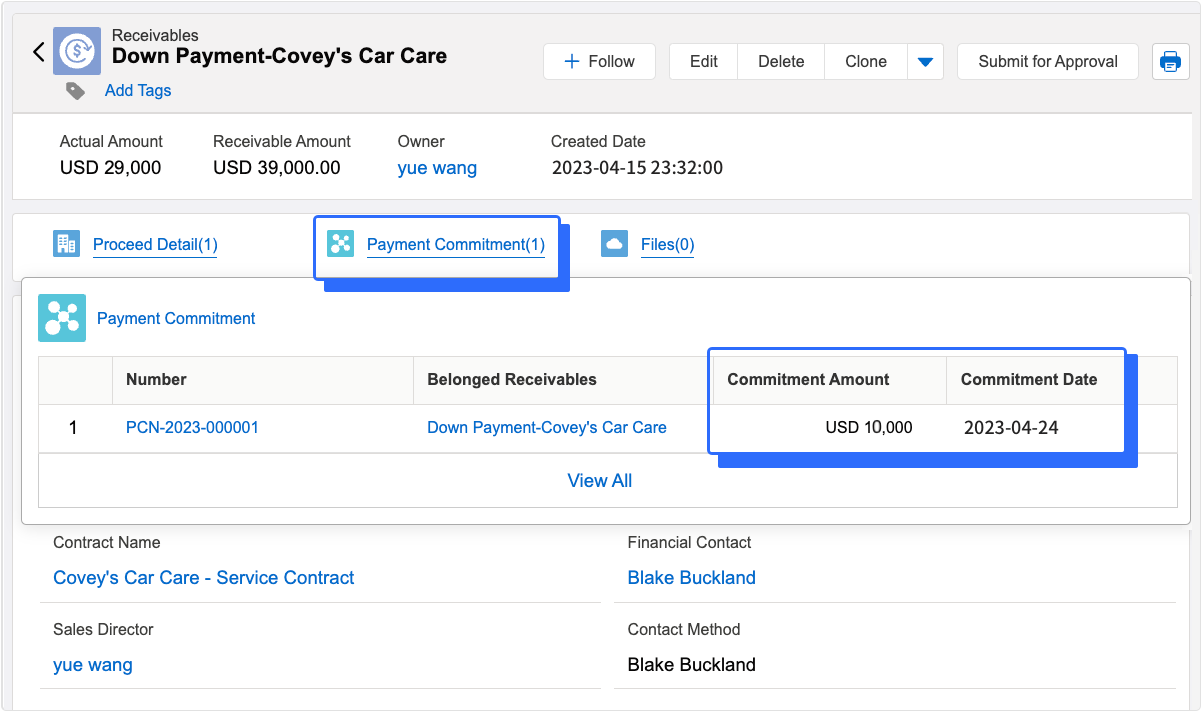

The salesperson is required to form a payment commitment for the overdue receivable and submit the commitment according to the situation. And we will come to the sales meeting to confirm that the promised amount can be collected as promised so that we can effectively organize the company-level resources to make an effective breakthrough for the collection of that amount.

Step Five: Goal and Achievement

For enterprises that evaluate salespersons by their sales receivables and give commissions, CloudCC offers receivable management capable of dedicated goal and achievement management that divides receivable missions by month. Through comparison between the monthly goals and the sum of the total payment, planned receivables, and overdue payments, the forecast of the salesperson can be seen immediately. Therefore, the company may intervene in time to handle the gap to ensure a maximum completion of the payment goal.